How to improve your budgeting skills during the pandemic

We are living in scary times. The nation is in a health crisis but also a financial crisis. With so many of us losing jobs, having hours cut, or just facing financial uncertainty, a lot of us find ourselves in a major wake-up call moment in terms of our finances.

Even if you aren't facing financial hardship right now, the realization that things can change in an instant may have you considering your family's current financial position. But for so many of us used to sticking our heads in the sand when it comes to finances, where do you even begin when it comes to budgeting? We all know that budgeting is essential to financial success. Like anything in life, you have to have a plan when it comes to what money is coming in, how you will use it, and what your long-term goals are. Budgeting can help you reach those goals and make sure that sale at your favorite store doesn't distract you from what's really important in the long-run. I'm not a financial expert. I'm an average, middle class teacher who hates spreadsheets and enjoys sales. However, in light of the financial crisis, I've been paying more attention to our family's budget. Here are some tools and tips that have really helped me with my budgeting. 1. Focus on savings

When you're in panic mode, it's hard to look at the long-term. You want to self soothe, which means treating yourself to quick purchases that make you feel better. But those small purchases add up.

Suze Orman is a financial expert who I really admire. Her advice has always been to have savings equal to 8 months of your current household expenses. This means that you should have enough money saved to float you through eight months of essential bills and living expenses. It might sound overwhelming, but Suze is big on emphasizing the peace of mind that comes with saving. If you keep this big goal in mind, it will be easier to stick to your budget for small expenses and say "no" to the items you don't really need. 2. Calculate an effective budget

In order for a budget to work, you need to actually have it written out in detail. You need to allocate every dollar of income to a category. But for many, this is overwhelming. So many of us hate the idea of spreadsheets and calculations. Plus, there's the confusion that surrounds a budget. How much should you really spend on each category?

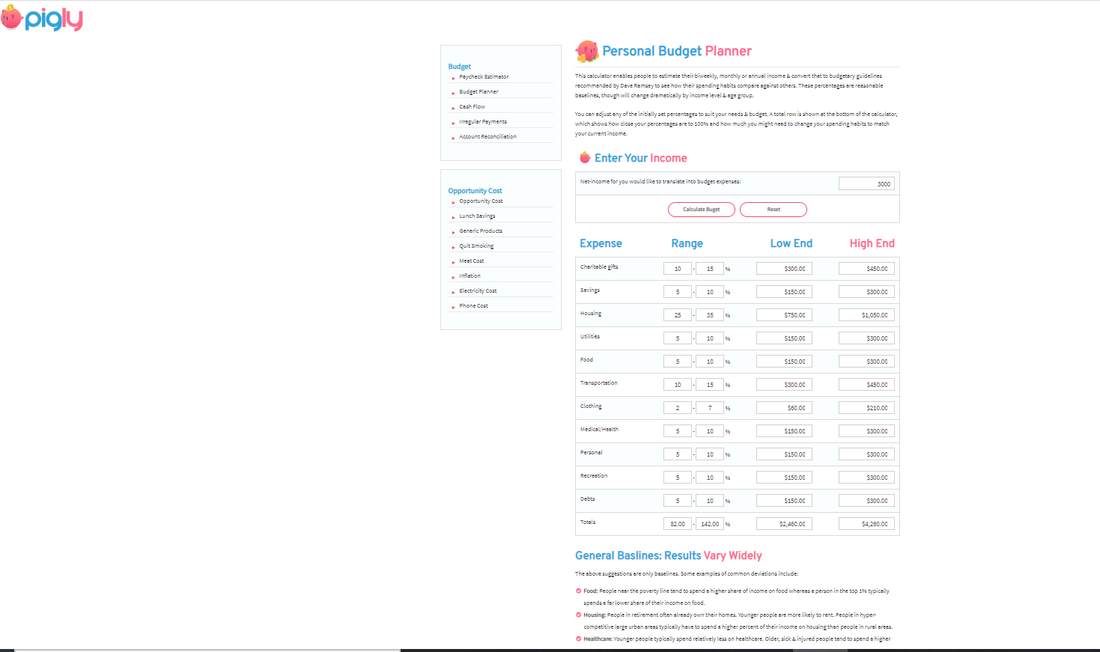

I've recently come across an amazing tool that does all of the work for you. The personal budget planner at Pigly.com helps you allocate your monthly income to various categories. It allows you to adjust those categories according to your expenses, and even gives you a low and high end cost for each category. I love that it serves as a foundation to create an effective budget. They also have other tools to help you decide if you can afford a car payment, how long credit card debts will take to pay off, and other useful financial tools that are free and easy to use. 3. Find Deals on Items You Love

Sticking to a budget doesn't mean you have to cancel all fun. There are ways to find cheap and inexpensive things to do with your family. Search coupon sites online for deals and sales on your favorite items. One of my favorite sites to find deals is the Krazy Coupon Lady. You can find entertainment, dining, and even household item deals and coupons that will save you money and help you achieve your budget.

4. Communicate with your family

In order for budgeting to work, you need to make sure your entire household is on board with your budget and financial goals. Have weekly finance meetings with your family to assess what is working, what isn't, and how you are doing at achieving your goals. You need to make sure that you are staying on track as a family.

My husband lost his job in the fall, and we have found that having weekly discussions about our finances and our goals has really helped us improve our finances and our relationship. There is less tension about our goals, our money, and our spending. We have learned to work as a team and move toward the common future we both want, which has been a really wonderful thing. The financial crisis won't last forever, but if you follow these tips, you'll leave 2020 feeling better about your financial direction, your finances, and your control of your money.

0 Comments

Leave a Reply. |

*As an Amazon Affiliate, I get a small fee for any books purchased through the links below.

Archives

May 2024

Categories

All

|

RSS Feed

RSS Feed